Indian firms are relatively well acknowledged for their ability to generate non-technical innovations such as new business models. For instance, the global service delivery model that emerged from India resulted in the advent of the Indian software industry. However, India’s competence in generating technological innovations is relatively unknown. This paper presents an analysis of Indian patent data to better understand India’s ability to produce technological innovations.

The gross domestic expenditure on research and development (R&D) in China, to which India is most often compared, increased from 0.9% of gross domestic product (GDP) in 2000 to nearly two percent in 2011. The significance of this increase lies in the fact that the national product grew at an average annual rate of nine percent during this period. India’s equivalent expenditure has stayed constant at around 0.9% for nearly a decade, the lowest among the BRIC economies. Given that technological and scientific progress generated by the discovery of new ideas is considered central to economic growth, India has limited inputs to scientific and technological innovation, including R&D spends and indigenous scientific capacity. Further, the density of the scientific workforce in India at one researcher per 10,000 labour force is also the lowest among the BRIC countries. Yet, little is known about the content of Indian’s technological output. To understand the key elements of India’s innovative output, particularly in science and technology, a comprehensive analysis of patents filed with the Indian patent office (IPO) between 1974 and 2007 is presented in this paper. The dominance of foreign entities, India’s innovative output and an evolving patent system provide an interesting backdrop for understanding the largely under-investigated innovation progress made by India.

Patents and Innovation

Studies correlating patents and the magnitude and nature of innovative activity are situated in the context of more developed countries. Patents are an accepted empirical proxy for innovative activity and affirm the importance of domestic innovation for economic growth. However, these endogenous growth stories are not well documented in developing countries, and it is unclear whether property rights or the lack thereof influences both indigenous and foreign innovative activity in emerging economies. Moreover, even patenting might not capture the whole picture as it may largely reflect domestic innovation and be concentrated in a few areas.

Given that technological and scientific progress generated by the discovery of new ideas is considered central to economic growth, India has limited inputs to scientific and technological innovation, including R&D spends and indigenous scientific capacity. Further, the density of the scientific workforce in India at one researcher per 10,000 labour force is also the lowest among the BRIC countries.

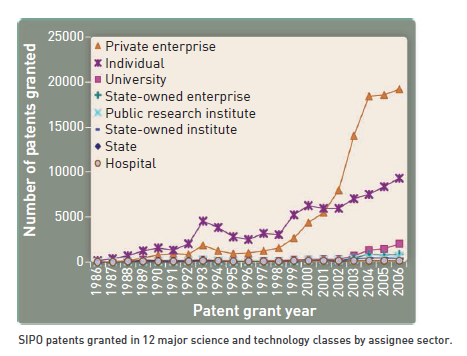

Innovation in China

The case of China suggests that strong economic growth in the country was concomitant with a rise in its indigenous innovative capabilities, with patents assigned to Chinese domestic entities accounting for over 58% of the total patents in the 12 major science and technology classes. This indicates that emerging economies seem to broadly conform to the idea that innovative activity responded favourably to stronger intellectual property (IP) laws that are better aligned with international standards.

China, however, has an active political structure that more often than not actively intervenes in the economy to promote substantive economic goals. Thus, it is unclear whether or not the China phenomenon may perhaps be an exception rather than the norm among developing countries. Does this finding hold good for another emerging economy– India?

Emerging Patterns in India

A cursory look at the total number of patents granted by India points to far fewer patents per capita than other developed and ascendant nations. Since India jumped on the global patent protection bandwagon rather late in the day (on signing the TRIPs agreement in 1993), the proportion of patents granted to India between 1994 and 2008 in the science and technology classes significantly lag behind the 44% granted to the US between 1986 and 2006 in the same classes. This is not, however, a developed versus emerging economy issue. This can also be observed in comparison to China. Although India has a significantly higher proportion of patents granted in the science and technology classes than China, the growth in the patents granted was much higher in the latter’s case.

Another interesting aspect is the low increase in year-on-year granted patents. A possible explanation would be the low levels of indigenous innovation in India, especially in science intensive industries, and the dominance of foreign entities in innovation in those industries. That brings us to the next question: Why are the majority of the Indian patents held by foreign entities?

Patents are an accepted empirical proxy for innovative activity and affirm the importance of domestic innovation for economic growth. However, these endogenous growth stories are not well documented in developing countries, and it is unclear whether property rights or the lack thereof influences both indigenous and foreign innovative activity in emerging economies.

To understand this, one has to acknowledge a dichotomy in the reasons to patent in India. Patents held by foreign entities appear to be driven by two factors: one where the entity patents for strategic reasons such as to license its technology to Indian firms without wanting to actively produce and sell products for Indian markets; and the other where the entity also operates in India and thus needs to protect its innovations. In order to further understand the factors that contribute to the dominance of foreign patenting in India, we would need to understand what spurs this dominance. An interesting fact is that a surprisingly large percentage (45%) of all granted patents were held by foreign entities that also operated in India between 1974 and 2008. While this is no small number after the TRIPs patent reform in 1994 this figure increased to about 51%.

However, it is not just the raw numbers that make us sit up and notice patenting in India by foreign entities. The surge in foreign patenting after TRIPs appears to have been driven by rapid increases in patenting by entities that were also manufacturing and selling products for Indian consumers. Significantly, this proportion was higher in the top 12 science and technology classes relative to other classes (48% versus 43%), and it also surged after TRIPs in the top 12 science and technology classes relative to other classes. In the top 12 science and technology classes, the proportion of patents held by foreign entities that also operated in India was about 55% between 1994 and 2007 as against the overall average of 48% in the same classes between 1994 and 2007.

Although India has a significantly higher proportion of patents granted in the science and technology classes than China, the growth in the patents granted was much higher in the latter case. Another interesting aspect is the low increase in year-on-year granted patents. A possible explanation would be the low levels of indigenous innovation in India, especially in science intensive industries, and the dominance of foreign entities in innovation in those industries.

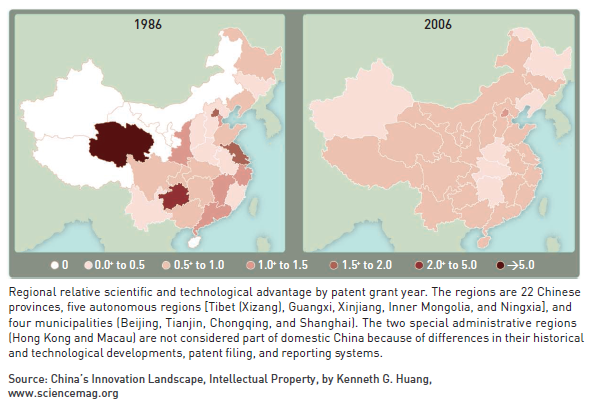

We observe, however, that patenting is not evenly distributed either across the 12 classes or the country. There are pockets of concentration and a perceptible pattern of geographic distribution. Utilising the relative scientific and technological advantage (RSTA) index, which is representative of scientific and technological capabilities in these 12 classes, the authors calculate a region’s share of patents granted by that region’s share of patents granted across all classes. A case in point is how the scientific and technological capabilities of the Eastern region in India have diminished over time while those of other regions have strengthened.

Looking to the Future

Knowledge economies such as India and China, though often compared to each other, show divergent patterns of patenting by foreign entities. A majority of patents in China are held by domestic entities while this is not the case in India. Their concurrence with TRIPs led to the emergence of different outcomes of domestic patenting in India and China. Foreign patenting was already dominant in India and it grew further post-TRIPs, especially in the science-intensive industries. In order to facilitate the extraction of the maximum value from the patenting ecosystem–the very ecosystem that has long supported the net consumption of technology produced elsewhere–emerging economies have to regularly assess policies, institutions, and scientific and engineering talent.

While foreign patenting is higher in India, instruments such as patents may not be enough to stimulate innovation in countries that lack the basic infrastructure to produce the scientific and engineering talent required to generate innovations. Countries such as India face a challenge in gauging the welfare impact of patents on domestic innovation, given that most of the patenting was by foreign entities either selling or producing their products in the country. Innovations need to effectively tap into local demand in emerging country markets and stronger patent laws may not necessarily have a positive impact on domestic patenting.

Importantly, the role of indigenous and foreign innovation efforts and their interactions in emerging economies are consequential. Aside from their contribution to India’s technological advancement, India’s GDP has more than tripled between 2000 and 2013, and its growth during this period is second only to China’s among the emerging economies. The substantial shift in global innovation landscapes requires multinationals to migrate to a more open innovation model that sources innovations from emerging economies. Paying attention to how patents accelerate domestic innovation would aid in understanding the gradual but noticeable change in innovative output in India, especially in the form of patents. There is evidence of increased foreign patenting, and its consequent effect on domestic patenting, trade and even entrepreneurship could affect policy decisions on a national level.

The substantial shift in global innovation landscapes requires multinationals to migrate to a more open innovation model that sources innovations from emerging economies. Paying attention to how patents accelerate domestic innovation would aid in understanding the gradual but noticeable change in innovative output in India, especially in the form of patents.

The safekeeping of intellectual property that arises from innovative ideas is often a daunting challenge that enterprises face today. India has demonstrated a gradual but noticeable change in the organisation of innovation activity. Given the rising complexity and multidisciplinarity of resources required for innovation, the protection of IP arising from these innovations is crucial to both domestic and multinational companies. These findings support the idea that respecting IP rights mitigates the weakening of incentives associated with domestic R&D.

The last few decades have heralded a change in technology and policy, which has significantly altered the landscape of drug discovery, R&D and product innovation in India. Our understanding of how domestic versus foreign innovation affects a country’s economic growth will facilitate the transformation of emerging economies to knowledge economies. Further, we need to ensure that domestic firm innovations are encouraged, given that technological progress is often regarded as the engine of economic growth and that the lack of such progress can have pernicious results.