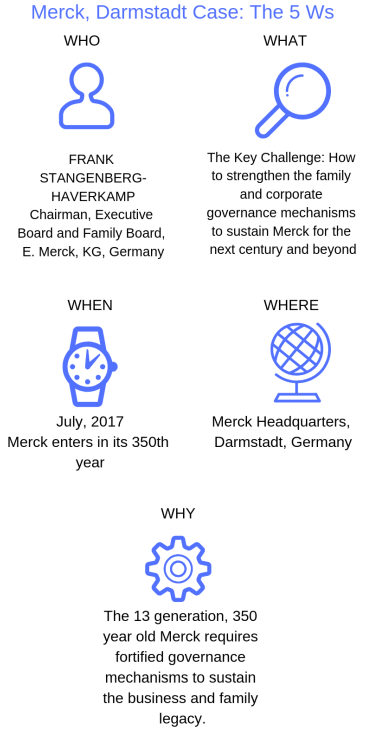

Merck, the oldest pharmaceutical and chemical company in the world, was founded in 1668 in Darmstadt a small town in Germany. The Merck family, with 156 family shareholders continues to own 70 per cent of the company and determines its strategic direction. Merck was criticised for organisational complexity on account of its 70 divisions and for making large, capital intensive international acquisitions. Due to complex management structures that caused a drain on the company’s financial resources, Merck decided to streamline its governance structures and incorporate itself as an Association limited by shares, floating 25% of its capital in stock exchange. This case examines the history of the Merck business and family, their involvement in business and their governance practices strongly rooted in values which helped them sustain across 13 generations and 350 years. While the company has launched its “Fit for 2018” campaign to streamline processes and improve productivity and profitability, the company faces a number of challenges in execution.

What intrigued you about Merck enough to write such a detailed case on the company?

One of the biggest challenges faced by family businesses worldwide is that of survival- most of them struggle to survive beyond three generations. In this backdrop, Merck presents itself as a unique family business case, of having survived through 13 generations of the Merck family spanning a long period of 350 years. This is most unusual for family businesses. Hence, we found the Merck story as particularly unique. We were also drawn into the case by the steadfast dedication of Merck leadership to continue to practice values and adhere to the culture of excellence, ethics and empathy. Yet another strength of Merck that drew our attention was their well-defined family and corporate governance mechanisms and structures, which most family businesses aspire for.

What would you consider as key takeaways for students, from the teaching of this case in the classroom?

Observing how so many family businesses continue to fall apart, one of the crucial learning outcomes for the students from the Merck case is the importance of family governance in these businesses. Studying the strategies employed by Merck to grow and sustain itself shows one how to build family businesses as long-lasting institutions, rooted in sustainable governance structures over generations. If you take examples from Indian business groups, you will find that a fair amount of disagreement stems from the inter-generational differences, which often lead to the business disintegrating, or closures/ mergers. This happens largely because of lack of clearly defined governance criteria and mechanisms. Merck leadership, on the other hand, was so far-sighted that in as early as the 1850s, they had drafted a structured family constitution that would go on to establish the rules for the family and its involvement in the company for years to come. Thus, another key takeaway is that a family business must learn to anticipate the requirement of such governance norms, and act accordingly in advance. This allows the business leadership to spend more time in the long run, focusing on operations and strategy, rather than constantly fire fighting against contingencies that may arise due to conflicts in the family.

How would you say Merck used governance to build itself up as an institution?

In a family business, initially, there are only a few key players. However, as the family grows different branches join in and it becomes more complex. Then the challenge is -How do you keep everyone together? How can a mechanism be devised that is fair, objective and has a buy-in from everyone? In this respect, the key strategy at Merck was the transference of family values, a culture of excellence and steward leadership from one generation to another. Their focus was on capability and leadership building, such that there were able to develop new, effective steward leaders in every generation.

In terms of business takeaways, Merck knew that it had limitations in terms of scale, scope and finances. Therefore, they focused on niche areas and super specialisation. They identified and developed super-speciality pharmaceuticals and chemicals. When a product gained wider market acceptance and sales volume grew to a pre-determined threshold, Merck used to sell that brand to a larger, well-established mass-market player. This was a conscious strategic decision as Merck knew that it could not compete in mass markets which had large and fierce competitors with deep pockets. As it sold one product that it had made popular, Merck focused on conducting cutting-edge research on another product. Thus, Merck always remained at the cutting-edge of research in each of the product categories it was present in. R&D was one of their key strengths. Importantly, Merck management had developed the market sensing capability of determining when to exit from a product/ market. Their focus was not on relentlessly pursuing top-line growth but on maintaining profitable technology leadership in all their product categories through cutting-edge research and innovation.

How did you gain access to the company?

The present Chairman of Merck, Dr Frank Stangenberg-Haverkamp had an association with the Witten Herdecke University of Germany, where Professor Kavil Ramachandran had taught courses in family business management as a visiting faculty. He invited Dr Frank to share his experiences with the delegates at the family business conference at ISB. It was then that we realised it would be a good idea to write a case on this company which was about to celebrate its 350 years.

What was it like co-authoring with academicians from diverse backgrounds of knowledge?

The best thing about working with a diverse set of authors was that they all brought different capabilities and these specialisations complemented each other. For example, Professor Ramachandran had been working on family businesses for several years, so he brought his deep understanding and experience of the way a multi-generational family business functions to this case as well. Professor Sougata Ray teaches strategy, so he looked at the Merck case in terms of strategic direction. Professor Andrea Calabro brought in the European context that was integral to studying Merck, which has its origins in Germany, and the overall international business perspective. As for myself, I looked at the tactical and execution aspects of the case, which included iterative crafting of text and exhibits. As authors, we were most thankful to Dr Frank and the team at Merck who were very helpful in giving us their time and for sharing with us their experiences and insights. Working together, I think we all managed to combine our distinct capabilities to create a holistic family business case, which educators across the globe may find to be an effective teaching tool.

About the Case Authors:

Dr Navneet Bhatnagar, PhD, CFBA is Senior Researcher at the Thomas Schmidheiny Centre for Family Enterprise, Indian School of Business.

Professor Kavil Ramachandran is Clinical Professor and Executive Director, Thomas Schmidheiny Centre for Family Enterprise, Indian School of Business.

Professor Andrea Calabro is Professor at IPAG Business School, France.

Professor Sougata Ray is Professor of Strategic Management at IIM Calcutta.

About the Writer:

Samriddhi Mukherjee is a Content Associate at the Centre for Learning and Management Practice at the Indian School of Business.

About the Case:

Bhatnagar, N., Ramachandran, K., Calabro, A., Ray, S., 2018. “Merck, Darmstadt: Sustaining Legacy Beyond 350 Years”. Indian School of Business case. Harvard Business Publishing

For more information: https://hbsp.harvard.edu/product/ISB123-PDF-ENG?t=merck&itemFindingMethod=Search