In this article, Pranai Agarwal examines the Indian government’s decision to move from its historical reliance on the wholesale price index (WPI) to the consumer price index (CPI), to measure the inflation rate in India. He observes that the move is a wise one, and that it will provide us with a more accurate picture of the economic situation in the country. However, the CPI, in its current form, is imperfect and has its limitations, and these must be addressed as soon as possible.

What is inflation to a common man? Is it about the daily haggling and cursing over the rising vegetable prices or is it about the rich and almighty sighing over the increase in the price of a BMW 6 Series from INR 11.5 million to INR 13 million? However you define inflation, the truth is that, it hurts the people as a whole and yet we cannot figure out a realistic solution to deal with it. This is primarily due to the multiplicity and complexity of indices used by India to measure price rise. Former Reserve Bank of India (RBI) Governor, D Subbarao, in a 2010 speech at the Peterson Institute for International Economics in Washington DC, summed up the problem in these words: “In India, we have one wholesale price index and four consumer price indices. There are ongoing efforts at a technical level to reduce the number of consumer price indices, and I believe the technical issues are not insurmountable. But that still will not give us a single representative inflation rate for an emerging market economy with market imperfections, diverse geography and 1.2 billion people.”

India’s Dependence on Multiple Indices

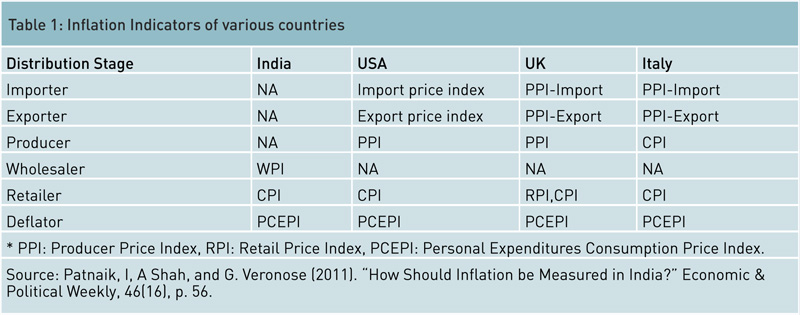

Other countries also use multiple measures of inflation (see Table 1). However, unlike those countries, India does not collect and collate information on some of the measures that are available elsewhere, due to its heavy reliance on the consumer price index (CPI) and wholesale price index (WPI) as measures of price rise.

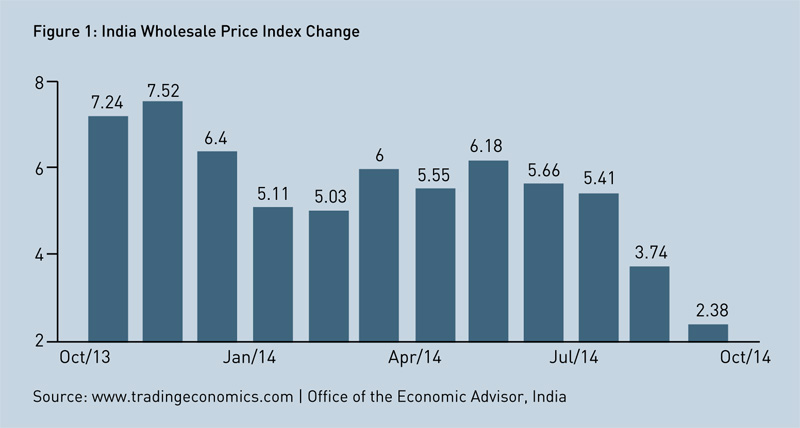

When other developing economies were using the CPI as a measure of inflation, India chose to use the WPI due to its national coverage and timely release. It is only recently, in April, 2014, that the government made a bold and well-thought-out decision to move to the CPI to measure the inflation rate in the Indian economy. The WPI (3.74 percent in August), also known as headline inflation, measures the change in wholesale prices of all the goods produced in the economy, with manufactured products, fuel and power having major weightages. The CPI (7.80 percent in August), on the other hand, is more of a common man’s index as it provides numbers on the retail prices of the goods and services consumed by the average Indian, both rural and urban; it is a true indicator of the cost of living.

WPI numbers are updated on a weekly basis whereas CPI numbers are updated on a monthly basis. Though the Central Bank (RBI) and the government have been targeting the WPI for a majority of their policy decisions over the years, this index does not reflect the prevailing prices and neither the current conditions from the consumers’ perspective. For instance, although WPI inflation numbers might be down for a month this benificial effects don’t trickle down to the common man, who still feel burdened by rising prices. Food price inflation accounts for much of the divergence between the two indices, although food is a major component of both the indices. This paradox has been recognised by economists at RBI, and needs greater attention and understanding at the governmental level as well.

The Best Measure for Inflation in India

We now come to the question of what is the best measure for inflation in India and which measure is most relevant to the Central Bank (for monetary policy), as well as to the common man in India. Various factors must be considered when making this important choice that will determine our very survival − the timeliness of measurement, importance given to food and energy in the two baskets, inclusion of relevant services, accuracy & frequency of data collection, and finally, the weightages attached to each component. CPI and WPI numbers have skyrocketed over the past few years, with the WPI averaging around 5.5 percent and the CPI averaging 7.5 percent (see Figure 1). This problem of high and volatile inflation should not be kept on the back burner, citing information quality issues as a reason.

Inflation expectations is something that the Central Bank would like to control as this would help RBI move expectations up and down the Philips Curve, and reduce unemployment without affecting the actual rate of inflation. However, this number is not in the hands of the RBI (open mouth operations do not have much credibility in India), but in the hands of the public. The bandwagon effect is a major determinant of expected inflation in India, where rumours about increasing inflation have a huge carryover effect to the rest of the gullible population, eventually resulting in a majority of the population expecting rising prices in the future. People need to realise that an increase in onion prices, worldwide oil prices or in the price of their dream car does not, and should not, affect the overall perception of inflation in the country, as only the relative price of these commodities has gone up compared to the other 600 items on the CPI and WPI indices. Why then should the overall expectations of inflation increase, further leading to a rise in the actual inflation rate?

The Role of Media

The media has a major role to play in making or rather building of this perception and negative network externality effect. A newspaper reporting that the poor monsoon in India will increase the rate of inflation, will dampen the mood of the Indian consumers (already reeling under many other problems), who will further adjust their inflation expectations of all goods and services upwards. Thus, no matter what policy decision the RBI takes next (whether using or not using game theory to anticipate consumer inflation expectations), high inflation and increasing dissatisfaction are a given.

Though the Central Bank (RBI) and the government have been targeting the WPI for a majority of their policy decisions over the years, this index does not reflect the prevailing prices and neither the current conditions. For instance, although WPI inflation numbers might be down for a month, this effect does not flow down to the people, who still feel burdened by rising prices. Food price inflation accounts for much of the divergence between the two indices, although food is a major component of both.

Mismanagement of Public Distribution Mechanism

Monetary policy measures undertaken by the RBI (e.g. increase or decrease in money supply) and fiscal policies undertaken by the Indian government (e.g. increase or decrease in spending or taxes) work by affecting the aggregate demand in the economy. However, the problem India faces is not in demand management, but in supply constraints and bottlenecks. Every year, millions of tonnes of rodent-infested food grain worth billions of US dollars rot in government warehouses across the country, while tens of millions of people go to bed hungry. This food grain is rather used to feed cattle and fish or are exported since the state governments have neither the incentive nor the infrastructure to procure, store and distribute the excess food grains.

Deaths due to malnutrition and shortages of basic food items scream from the front pages of our newspapers, even though there is no actual shortage of food in the country. In Punjab, 15-metre high piles of decomposing grain lie in the open, exposed to scorching temperatures or heavy downpours, in areas of the size of football grounds. India ranks 65th out of 79 countries in the Global Hunger Index, faring worse than our neighbours-Pakistan and Bangladesh, even after the government provided mid-day meals to 120 million children in the country. Who can explain this paradox of plenty?

This is the first time in the country’s history that overproduction is leading to a shortage of food across India. Shortages in the supply of essential food items such as wheat, rice, maize and pulses are due to the corruption-induced public distribution system, lack of storage facilities and the inefficient system of distributing food subsidies to the farmers of India. The complex procurement and distribution system on which the government relies could well explain why the mountains of food grain being produced are not being diverted to the stomachs of India’s ever growing population (which might include the future leaders of tomorrow).

The resulting food inflation keeps the common man (as well as the RBI) up all night, and the causation between supply constraints and food shortages should keep the government up all night too. Despite the Supreme Court’s order in 2010 to distribute food grain to the poor for free rather than letting it rot, nothing seems to have been done towards that end. We need to get our priorities right and quickly too. India cannot claim to be a superpower when millions of its citizens go hungry every day. Food has not been on the top of the national agenda for decades. This is not my opinion alone; many others have expressed their concern in different ways over the last couple of years. “This is a case of criminal neglect by the government. The ruling party [at that time, the Congress] has been the worst manager of the demand-supply of food grains,” said D Raja, National Secretary of the Communist Party of India, an opposition group.

Single Index is Not Enough

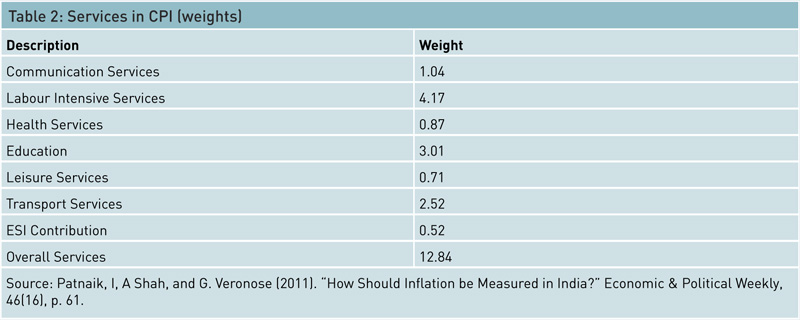

One needs to realise that a single index cannot be used to capture inflation details in a vast country like India, however broad that index may be. The RBI should keep in mind the following when deciding upon its inflation measure: the target population (consumers or producers), the items that need to be included or excluded from the relevant measure, the weight attached to these items, and most importantly, the timely, reliable, accurate and frequent measurement of the prices. The RBI has made the wise decision to move to the CPI (both urban and rural) and update the base from 2004-05 to 2010, given the brittle economic situation India is in today. The CPI is a much broader measure than the WPI and tracks the prices of the basket of goods and services that have an impact on the common man as well as the high-flying corporate class. The WPI is an ineffective measure also because it is strongly influenced by the fluctuation in global prices of tradeable goods and the constant currency fluctuations. Further, unlike the WPI, the CPI accumulates and hence reflects data from both the rural and the urban areas, giving a much more complete picture of the Indian economy. The CPI also has an edge over the WPI as it includes certain miscellaneous services (e.g. medical care, education, transport and communication) in its calculation. With services accounting for a large chunk of the Indian gross domestic product (GDP), they are a critical component of the inflation measure in India (see Table 2). As a of other economic variables, such as nominal GDP and current account deficit (CAD) rely on the WPI, the shift to the CPI will happen over time.

The media also has a small role to play in this bandwagon and negative network externality effect. A newspaper reporting that the poor monsoon in India will increase the rate of inflation, will dampen the mood of the Indian population (already reeling under many other problems), who will further adjust their inflation expectations of all goods and services upwards.

Recent debates are aiming to reduce the weightage of unprocessed food by one percent and increase the weightage of manufactured goods by three percent in the WPI, making it more focussed on core inflation and less on food inflation. According to economic advisers and the past governors of the RBI, the WPI is here to stay and will only add value to the main CPI measure of inflation, giving a holistic view of the state of prices in the economy.

Limitations of CPI

However, even in its current form, the CPI does have certain limitations as a measure of inflation, such as the unequal weightage given to food (48 percent in the CPI vs. two percent in the WPI), unequal representation of the rural vs. urban population and an inadequate representation of services. The Indian Government and the RBI should focus their efforts on reducing the weightage of food in the CPI so as to get a more accurate representation of the other 500 plus goods and services that have been included in this measure. If this is not done, the indicator may be dominated by supply side factors majorly. Also, RBI’s monetary policy should move away from headline WPI and towards the more realistic CPI in order to provide a more accurate representation of economic fundamentals. Only time will tell whether this newly adopted measure of inflation benefits or disadvantages India even further.

The GDP deflator, the broadest measure of inflation in India, has also been rejected by the RBI due to its use of proxy indicators of quantity and also due to the time lag in publication of this number. As food prices are a major contributor to high CPI inflation and are not under the control of the RBI’s monetary policy, the central bank needs to adopt a new game strategy and come up with two measures of CPI: one that includes food and the other that excludes food. Having said that, it also needs to adopt different measures and policies to counter each of these measures due to the difference in the weightages of items. Lessons must be learned from other countries such as the U.S., where the measure of inflation − the personal consumption expenditure index − excludes food and energy prices.

The CPI is a much broader measure than the WPI and tracks the prices of the basket of goods and services that have an impact on the common man as well as the high-flying corporate class. The WPI becomes an ineffective measure also because it is strongly influenced by the changes in global prices of tradeable goods, as well as by the constant currency fluctuations. Further, unlike the WPI, the CPI accumulates and hence reflects data from both the rural and the urban areas, giving a more complete picture of the Indian economy.

Although the current government has undertaken a slew of measures to crack down on hoarders, negative sentiments and the resulting bandwagon effects should be kept at bay to lighten and improve the mood and investor sentiment in the country. Inflation must be controlled in the near future by the RBI to reduce interest rates, boost the economy and propel growth above the trending five percent mark. Possible solutions include the creation of a single nationwide agricultural market, investment in cold storage facilities and transportation, and a go-ahead to foreign direct investment (FDI) in multi-brand retail. Not only do decisions need to be made quickly regarding the measure of inflation and the items it should include, but minimum support price hike decisions and supply bottlenecks also need to be dealt with as soon as possible. To achieve the unachievable, the RBI and the government need to work in sync. After all, we wouldn’t want a repeat of the Tahrir Square revolution at our very own Ramlila Maidan, would we?

FURTHER READING

- Aos, S., P. Phipps, R. Barnoski, and R. Lieb, 2001, The Comparative Costs and Benefits of Programmes to Reduce Crime. Version 4.0, Washington State Institute for Public Policy, Website: http://www.wsipp.wa.gov/Reports/01-05-1201, Accessed on 01/10/2013

- Badawy, M., 2012, California City Seeks to Cut Asthma Rate via Bond Issue, Oct 19, 2012, Reuters.com, Accessed on 01/10/2013

- Cave, S., Williams, T., Jolliffe, D. and C. Hedderman, 2012, Peterborough Social Impact Bond: an independent assessment, Ministry of Justice Research Series, 8/12.

- Culhane, D. P., S. Metraux, and T. Hadley, 2002, Public Service Reductions Associated with Placement of Homeless Persons with Severe Mental Illness in Supportive Housing, Housing Policy Debate, 13, pp. 107-163.

- City of New York, Office of the Mayor, 2012, Mayor Bloomberg and Deputy Mayor Gibbs and Corrections Comissioner Schriro announce nation’s first social impact bond, 08/02/2012, www.nyc.gov

- The Economist, 2013, Suffer the Children, Democracy in America Blog, January 30, 2013, Accessed on 01/03/2014

- Larimer, M. E., D. K. Malone, M. D. Garner, D. C. Atkins, B.Burlingham, H. S. Lonczak, K. Tanzer, J. Ginzler, S. L. Clifasefi, W.G. Hobson, and G. A. Marlatt, 2009, Health Care and Public Service Use and Costs Before and After Provision of Housing for Chronically Homeless Persons with Severe Alcohol Problems, Journal of the American Medical Association, 301, pp. 1349-57.

- MacKenzie, D. L., 2000, Evidence-based Corrections: Identifying What Works, Crime & Delinquency, 46, pp. 457-471.

- Martinez, T. E., and M. R. Burt, 2006, Impact of Permanent Supportive Housing on the Use of Acute Care Health Services by Homeless Adults, Psychiatric Services, 57, pp. 992-999.

- McKinsey and Company, 2012, From Potential to Action: Bringing Social Impact Bonds to the US Salit, S. A., E. M. Kuhn, A. J. Hartz, J. M. Vu, and A. L. Mosso, 1998, Hospitalization Costs Associated with Homelessness in New York City, New England Journal of Medicine, 338, pp. 1734-1740.

- Timmons, H, India’s Anti-Poverty Programmes are Big but Troubled,New York Times, May 18, 2011.

- Wintour, P., 2012, Social Impact Bond Launched to Help Teenagers in Care and the Homeless, The Guardian. November 23, 2012.