What are the determinants and consequences of overseas acquisitions by Indian firms in their internationalisation journey? Professor Raveendra Chittoor’s and Deepak Jena’s survey-based study addresses this question and highlights key issues related to overseas acquisitions, such as acquisition motivation, choice and location of acquisition targets, post-acquisition integration processes and acquisition performance

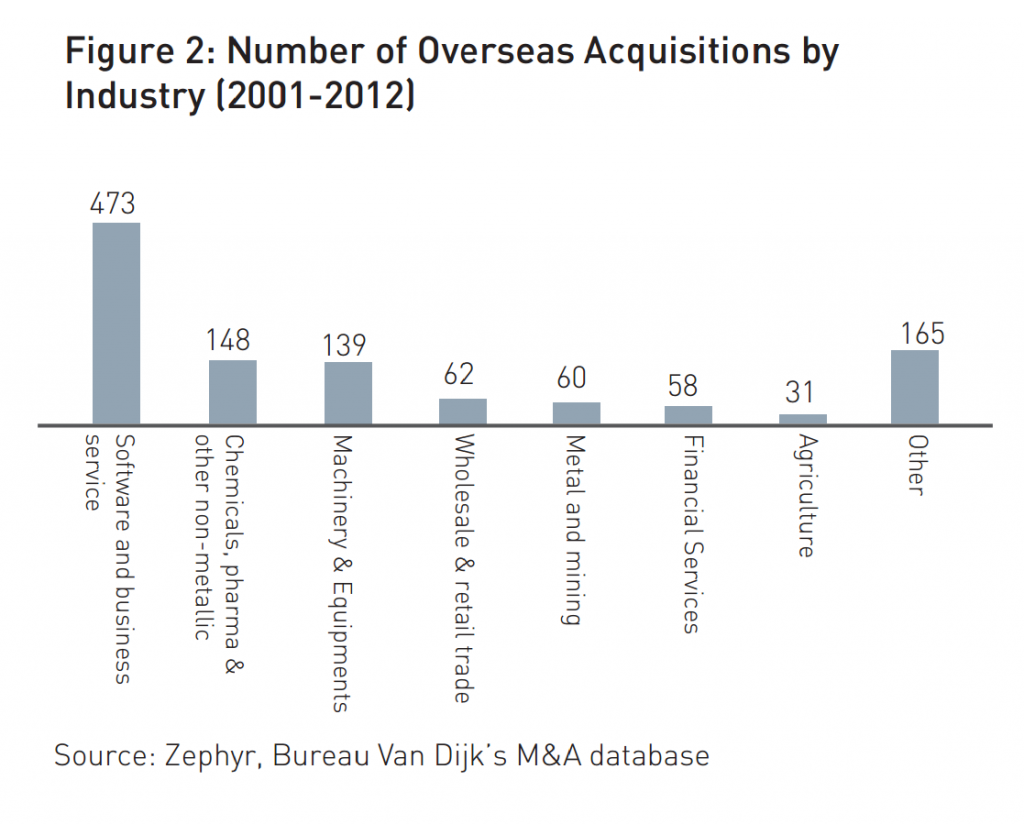

Indian companies have been aggressive dealmakers in the market for corporate control overseas during the past decade. Between 2001 and 2012, Indian companies executed more than 1,100 cross-border merger and acquisitions (M&A) transactions (Figure 1), 80% of which gave them a controlling stake, according to Zephyr, Bureau Van Dijk’s M&A database. These acquisitions were spread across multiple industries, with software and business services and pharmaceutical acquisitions being among the biggest industry groups (Figure 2).

India’s top TNCs (featured in the article “Ranking India’s Transnational Companies”) in this issue have also shown a great appetite for undertaking cross-border acquisitions in the past decade. The 25 companies that feature in our TNC list made at least 84 overseas acquisitions between FY02 and FY12, thus averaging more than three per company1. This preference for growing internationally through acquisitions is, according to us, the key distinguishing feature of the internationalisation journey of top Indian TNCs.

Some of the featured companies preferred the big bang approach by making large international acquisitions – sometimes much larger in size than themselves. At the time of Tata Steel’s acquisition of Corus (2006-07), Corus was four times the size of Tata Steel in terms of revenues (US$4.6 billion for Tata as of March 2006, versus US$19 billion for Corus as of December 2006) and 3.5 times its size in terms of assets, according to data from S&P Capital IQ. Similarly, in the 2007 Hindalco-Novelis deal, Canadian aluminium manufacturer Novelis had more than two times the revenue of Hindalco (US$9.8 billion for Novelis as of December 2006, compared to US$4.5 billion for Hindalco as of March 2007) and about 1.6 times the assets.

However, some of the other companies in our list relied on a series of smaller international acquisitions to expand their international presence. Consider, for example, Godrej Consumer Products Limited (GCPL), which ranks fourth in our list of top 10 TNCs with foreign assets of less than US$500 million (see the lead article “Ranking India’s Transnational Companies.” GCPL has used international acquisitions as the primary route to internationalisation. GCPL had a very modest international presence until the mid-2000s. Since then, however, as part of its “3×3 globalization strategy”2 to penetrate deeper into Asia, Africa and South America with three product segments (personal wash, hair care and insecticides), GCPL has made at least nine overseas acquisitions in the last eight years. For GCPL, most of the growth in its international business can be attributed to international acquisitions. Core Education & Technologies Ltd has also followed a similar strategy of undertaking serial acquisitions (seven acquisitions in the past decade). A list of recent international acquisitions by our featured companies is provided in Table 10.

The 25 companies that feature in our TNC list made at least 84 overseas acquisitions between FY02 and FY12, thus averaging more than three per company. This preference for growing internationally through acquisitions is, according to us, the key distinguishing feature of the internationalisation journey of top Indian TNCs.

Unique Drivers of Acquisitions by Indian Companies

Role of Owner-CEOs: While numerous studies have established overseas acquisitions as the predominant mode of internationalisation by emerging economy firms over the past decade, we are yet to understand some of the fundamental drivers of this distinct and risky internationalisation mode. We explore some unique drivers or determinants of the propensity among Indian firms to make acquisitions.

Firms owned and controlled by business families (as against widely held firms) constitute a majority of the firm population in emerging economies such as India. Also, a majority of these family firms in India are headed and managed by members of the owner family (“owner-managers”). Over 60% of the Indian companies in the BSE 500 index have chief executive officer (CEOs) who are also members of the promoter/ owner families. These owner-managers have played a key role in ensuring their firm’s rapid internationalisation, and in cases where the firm has internationalised mainly through overseas acquisitions, their role has probably been even more crucial.

Compared to other internationalisation modes, such as licensing, exports, joint ventures or greenfield projects, foreign direct investment (FDI) through overseas acquisition is considered a high-involvement and high-risk mode of internationalisation. Such acquisitions constitute high-risk strategic decisions that require the approval and buy-in of all the shareholders. Having an owner (or one of the owners) also act as the CEO seems to better facilitate such strategic decision making. In a separate study, the authors analysed the M&A activities of Indian companies in the BSE 500 index and found that these companies had executed a total of at least 372 overseas acquisitions between financial year (FY) 2002 and FY2012.Of these 372 acquisitions, firms in which the owners also acted as CEOs accounted for a predominant chunk (244 acquisitions or 65% of the total).

Support from Business Groups: A second important factor that we came across in our studies on acquisitions is the role of “business groups” in influencing a firm’s internationalisation through overseas acquisitions. Entrepreneurship in emerging economies typically starts off with a standalone family firm, which then diversifies into multiple businesses, each held in a different firm under common ownership – an organisation structure commonly known as a business group. Such groups control and coordinate two or more distinct firms, often in different businesses, through commonly held equity ownership stakes that are often complemented by social ties. In India, popular examples of such business groups are the Tata group and the Aditya Birla group. We observed that the Indian business group-affiliated BSE 500 firms, on an average, made more acquisitions than non-business group-affiliated BSE 500 firms (1.2 acquisitions as compared to 0.5 acquisitions per company on average). Business groups often act as an internal market for resources such as capital, human capital and information for their affiliated firms. The availability of such resources differentiates business group affiliated firms from standalone firms, and thus, plays a critical role in facilitating the member firms’ international expansion efforts through acquisitions.

Surveying the Motivations of Acquisitions by Indian TNCs

Given that most emerging economy firms, including Indian TNCs, have relied heavily on cross-border acquisitions to drive their globalisation activities, it will be useful and timely for practitioners and academics to understand the various determinants and consequences of such acquisitions. There are hardly any studies in the context of emerging economies that have critically examined important issues related to overseas acquisitions, such as acquisition motivation, choice and location of acquisition targets, post-acquisition integration processes and their subsequent effect on acquisition performance. A few studies that have done so have relied primarily on secondary sources of data (press reports, company filings, etc.), which are limited in their disclosures. We took a different approach in this study, and sought insights directly from the senior managers of Indian companies involved in such acquisitions. By adopting the survey approach, we were able to obtain rich and valuable insights that are normally not available from public sources (such as acquisition motivation, post- integration mechanisms, acquisition performance as against targeted goals, etc.). Given the reluctance of Indian companies to share internal data, particularly on a sensitive theme such as acquisitions, the response to our survey was reasonably good. We were able to collect information on 35 acquisitions by 15 TNCs. The average deal value for the sample set (taking into consideration 24 deals for which deal value information is publicly available) was US$427 million while the median was US$57 million.

The average deal value for the sample set (taking into consideration 24 deals for which deal value information is publicly available) was US$427 million while the median was US$57 million.

Key Motivations for Overseas Acquisitions: Firms undertake acquisitions overseas for four broad reasons. Some acquire overseas companies to penetrate new markets or maintain existing ones (market-seeking motivation)3. For example, Dr Reddy’s Laboratories’ (DRL’s) acquisition of Betapharm, a large generic pharmaceutical company in Germany, can be classified primarily as a market- seeking acquisition. DRL acquired Betapharm in 2006 to gain a larger foothold in the lucrative European generics market.

Another motivation for firms could be to acquire factors of production, primarily natural resources (resource-seeking motivation). ONGC’s acquisitions of and investments in overseas oil assets are examples of resource seeking behaviour. The third broad rationale is efficiency seeking, where companies make investments aimed at increasing efficiency (efficiency- seeking motivation). Efficiencies could be in the form of accessing cheaper labour, or to exploit benefits of scale and scope. DRL’s acquisition of Roche’s active pharmaceutical ingredients (API) assets in Mexico can be categorised as an efficiency-seeking acquisition. This acquisition enabled DRL to establish a manufacturing footprint in Mexico (primarily to help serve its North American customers better) at a much lower cost than it would have incurred had it decided to build its own facility from scratch. Firms can also make overseas investments to acquire knowledge assets such as brands, patents and relationships with clients, etc. (asset-seeking motivation). Several of the technology acquisitions by Indian information technology (IT) companies are asset seeking in nature as these acquisitions help them enhance their products and technologies to better serve their global customers.

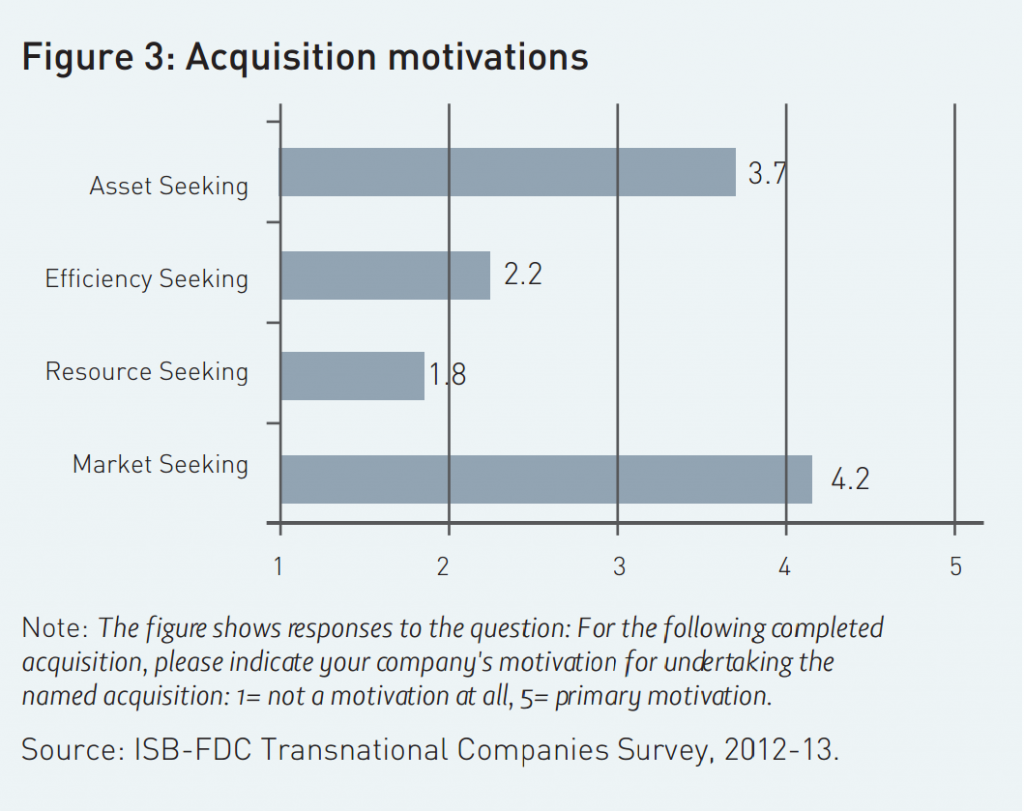

These diverse motivations are not mutually exclusive however – a single acquisition may have multiple rationales. For example, Hindalco’s acquisition of Novelis had at least three motives – market, asset and efficiency seeking. Respondents of our survey gave the highest scores to market-seeking (4.2) and asset-seeking (3.7) motives (Figure 3), indicating that these two are the primary motives behind the overseas acquisitions of Indian TNCs. Efficiency and resource-seeking motives score lower than 3, pointing to their relatively lower significance in the context of Indian companies.

Indian companies showed a high preference for investing in the developed countries of North America and Europe, which are culturally very distant.

Proximity/ Distance between India and the Country of the Acquired Firm: The existing international business literature suggests that firms prefer to make investments in regions (or countries) their home countries. A popular framework that underlines the important role played by distance in framework provides a simple approach to measure the distance between two countries based on four dimensions: cultural, administrative, geographic and economic (CAGE). The more two countries differ across these dimensions, the riskier it could be to acquire a target in the foreign country. A greater cultural distance between two countries could be due to differences in language, ethnicity, religion and social norms. The absence of colonial ties, shared monetary or political associations and differences in institutional environments could result in greater administrative distance between the home and host country. Greater geographic distance could be attributed to factors such as the lack of a common border, differences in country size or even climatic differences. Finally, differences in consumer incomes and in the cost and quality of resources and infrastructure between two countries could lead to greater economic distance. It is likely that firms will have a negative view about undertaking a particular overseas acquisition if their senior managers perceive that one or more of these distances between their home country and the country of the target is too high for comfort.

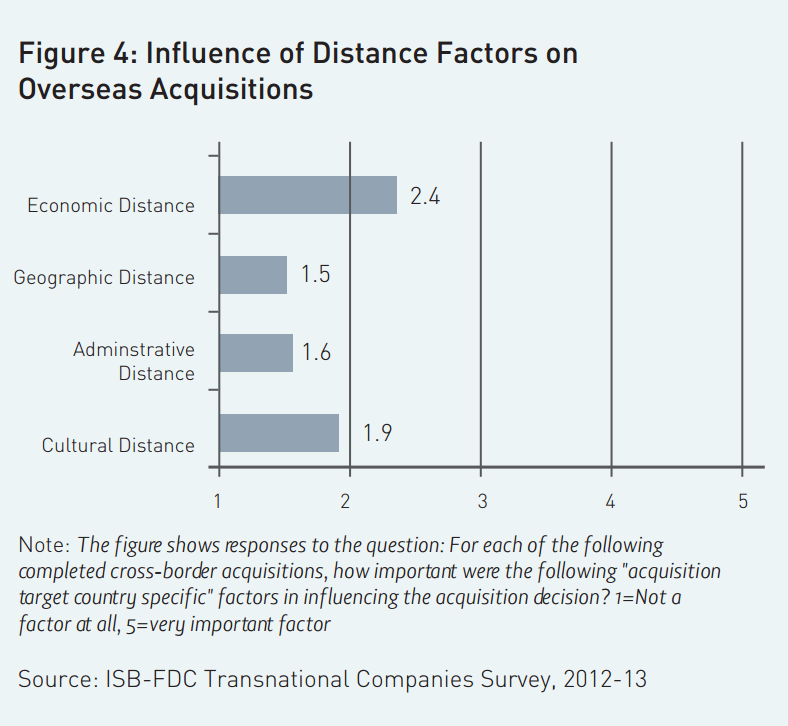

However, an analysis of acquisitions by Indian multinationals over the past decade reveals no such trend. Indian companies showed a high preference for investing in the developed countries of North America and Europe, which are culturally very distant. About 70% of all cross-border acquisitions by Indian companies (as captured by the Zephyr M&A database) between 2001 and 2012 were in the United States (US), Canada, United Kingdom (UK) and European Union (EU) countries.

We asked our survey respondents if any of these four distance factors played an important role in influencing their acquisition decisions. As expected, respondents rated all four of these distance factors very low (all less than 3 on a scale of 5; see Figure 4), suggesting that “market-seeking” and “asset- seeking” motivation considerations likely took precedence over “distance” considerations in their decisions on overseas acquisitions.

Post-Acquisition Integration Processes: A majority of all acquisitions fail to create value for the acquirers, and several of these acquisitions are believed to have failed primarily because of poor post-acquisition integration5. While the jury is still out on whether high or low post-acquisition integration leads to a successful acquisition, emerging market multinationals are believed to follow a different approach to post-acquisition integration (one that espouses less integration) compared to Western multinationals. In a widely cited Harvard Business Review article6, Kale, Singh and Raman have emphasised the notion and coined the term “partnering” to describe the integration approach preferred by emerging market multinationals. They define this approach as “keeping an acquisition structurally separate and maintaining its own identity and organisation” (p 109). The acquirers “retain the senior executives … give them the same power and autonomy they used to enjoy … simply lay down their (acquirers’) values to serve as a beacon … hunt for synergies in a few areas, carefully choosing those that aren’t disruptive to their acquisitions’ businesses … treat the acquired organisation as it would a partner in a strategic alliance” (p 109-110). In an article in the Global Strategy Journal Mike Peng of the University of Texas Dallas has called this a “high road” approach, compared to the “low road” approach generally preferred by developed country multinationals (2012: 101)7.

Kale et al describe five key ways in which companies that adopt “partnering” differ in their post-acquisition approach from those that adopt “integration.” Companies that adopt the partnering approach: 1) keep the acquired company separate rather than absorbing it completely; 2) selectively coordinate a few key business activities rather than integrate all core and supporting activities; 3) retain most or all of the acquired company’s top executives; 4) Give near total operational autonomy to the acquired company’s executives; and 5) proceed with integration at a gradual pace rather than at a rapid pace.

Respondents of our survey gave the highest scores to market-seeking and asset-seeking motives, indicating that these two are the primary motives behind the overseas acquisitions of Indian TNCs. Efficiency and resource-seeking motives score lower than 3, pointing to their relatively lower significance in the context of Indian companies.

In many cases, the acquisition motive directly influences the manner in which the acquired company is integrated. Companies will follow a more hands-off approach to integration when they believe that preserving the target’s unique culture is critical to achieving the acquisition’s goals. DRL follows the “partnering” approach for its research and development (R&D)-related acquisitions (asset- seeking motive) where, according to its CEO GV Prasad, it is important to “preserve [the target company’s] work culture, the scientific temperament and the talent that we have acquired”8. GV Prasad outlines the general philosophy behind DRL’s approach to integration as follows: “Even before we make the bid, we decide how we will integrate. So when we create the rationale for the acquisition and the hypothesis for value creation, we know exactly what we will do post-acquisition – whether we will go in and take costs out or whether we will go in and expand the group.”

We tested the framework proposed by Kale et al by asking our survey respondents about the integration process they adopted for their acquisitions. The results suggest that many of the top Indian TNCs featured in our ranking followed a “partnering” approach to integration (see Figure 5). In about 63% of acquisitions, the acquired companies were kept separate and not absorbed by the acquirers. Similarly, in about 60% of acquisitions, the acquiring companies undertook only a selective integration or coordination of key activities rather than a full integration of activities. Companies usually replace the entire top management team of the acquired company post-acquisition, but interestingly, for our sample acquisitions, this occurred in just three percent of the cases. Not only was the top management team of the acquired company retained, but in about 95% of the cases, the retained team was also accorded a high level of autonomy in managing operations. Finally, the results show that in about 70% of the acquisitions, the acquirer preferred a gradual pace of integration over a rapid one.

Acquisition Performance

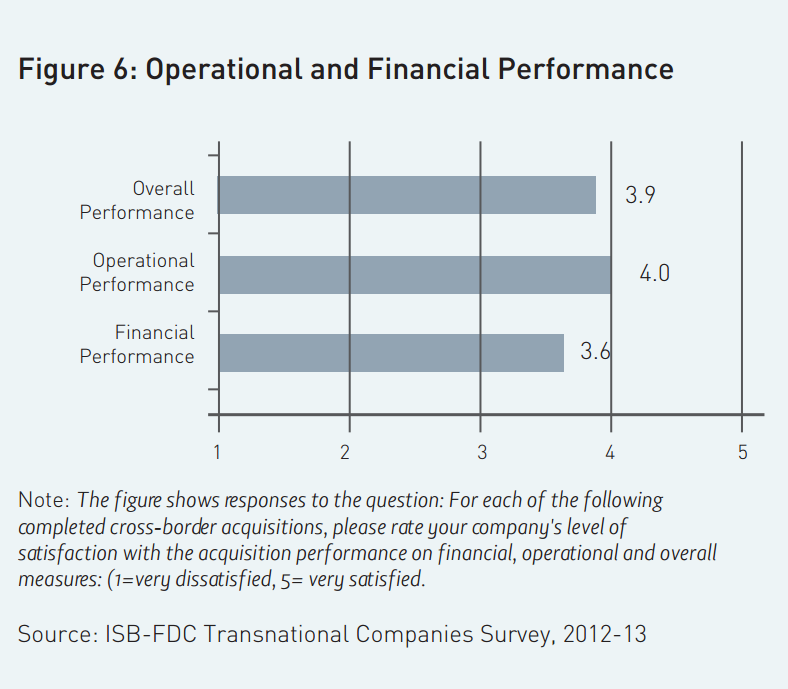

We conclude this article by summarising the survey responses about the performance of the acquisitions made by our respondents. We asked the respondents to rate the performance of the acquisition vis-à-vis pre-acquisition expectations. Results suggest that top Indian TNCs are, for the most part, satisfied with the outcome of their cross- border acquisitions. A high average score of 3.9/5 is an indicator of the respondents’ high satisfaction with the overall post- acquisition performance of their acquired companies (Figure 6). Respondents also showed higher levels of satisfaction with the operational performance of the acquired firms (for example, increase in market share, improvement in product/ service quality and brand image, introduction of new products, etc.) than they did with the financial performance (sales and profit growth) of the acquired firms.

Conclusion

As the introduction to this article argued, Indian companies are increasingly relying on cross-border acquisitions to fuel their globalisation ambitions. Given the importance of overseas acquisitions in the internationalisation journey of Indian TNCs, practitioners and academics are recognising the need to understand, in greater detail, the various determinants and consequences of such acquisitions. However, there have been very few studies in the context of emerging economies that have critically examined important issues related to overseas acquisitions, such as acquisition motivation, choice and location of acquisition targets, post-acquisition integration processes and their subsequent effect on acquisition performance. This survey-based study is possibly the first attempt to examine these different aspects in an integrated manner. Our study reveals that Indian TNCs are predominantly driven by market-seeking and strategic asset-seeking behaviour while making overseas acquisitions. These findings lend support to theoretical conjectures put forth by Gubbi et al in a 2009 article9, that emerging economy firms primarily use cross-border acquisitions to seek strategic assets and also to learn about foreign markets. While conventional logic dictates that companies would prefer to select acquisition targets in countries or regions that are similar (geographically, economically, administratively and culturally) to their home countries, this study suggests that Indian TNCs seem to assign much lower weights to these distance factors when making acquisition decisions. The survey findings also provide stronger support to Kale et al’s argument that emerging market-based firms prefer a “partnering” approach to integration, an approach that is different from the one favoured by developed country multinationals. Our study also suggests that cross-border acquisitions have created value for their Indian acquirers. This finding (about the positive, value-creating aspect of Indian TNCs’ overseas acquisitions) thus resonates with the results obtained by Gubbi et al using the event-study method10, in the context of emerging economies.

Acknowledging the smaller sample as a limitation of our study, we hope that this study will motivate researchers to conduct larger sample studies to explore, in greater depth, the critical linkage between acquisition motives and integration mechanisms, and their resultant effect on acquisition performance.

NOTES

1 Data was collected from multiple sources such as SDC Platinum and Zephyr for a related research project.

2 See Ganguly, Pallabika (2010): “Godrej Consumer Products to focus on new ‘3×3 strategy’”, Moneylife.in, April 27. Accessed June 10, 2013: http://www.moneylife.in/article/godrej- consumer-products-to-focus-on-new-3×3-strategy/5064.html

3 Dunning, John H (1998). “Location and the Multinational Enterprise: a Neglected Factor?” Journal of International Business Studies, 45-66.

4 Ghemawat, Pankaj (2001). “Distance Still Matters”, Harvard Business Review, 79(8): 137-147.

5 Pablo, A L (1994). “Determinants of acquisition integration level: A decision-making perspective”, Academy of Management Journal, 37(4): 803-836.

6 Kale, Prashant, Harbir Singh and Anand P Raman (2009). “Don’t Integrate your Acquisitions, Partner with Them”, Harvard Business Review, 87(12): 109-115.

7 Peng, Mike W (2012). “The Global Strategy of Emerging Multinationals from China”, Global Strategy Journal, 2(2): 97-107.

8 See interview with GV Prasad in this issue.

9 Gubbi, S R, P S Aulakh, S Ray, M B Sarkar, and R Chittoor (2009). “Do International Acquisitions by Emerging-Economy Firms Create Shareholder Value & Quest; The Case of Indian Firms”, Journal of International Business Studies, 41(3): 397-418.

10 An event study is a popular statistical method used by researchers to study the impact of an economic event (for example an acquisition) on the value of the firm. In case of an acquisition, this assessment can be done by observing the price change in the acquiring company’s stock price over a relatively short period of time and therefore ascertaining whether there was any “abnormal return” attributable to that focal acquisition.