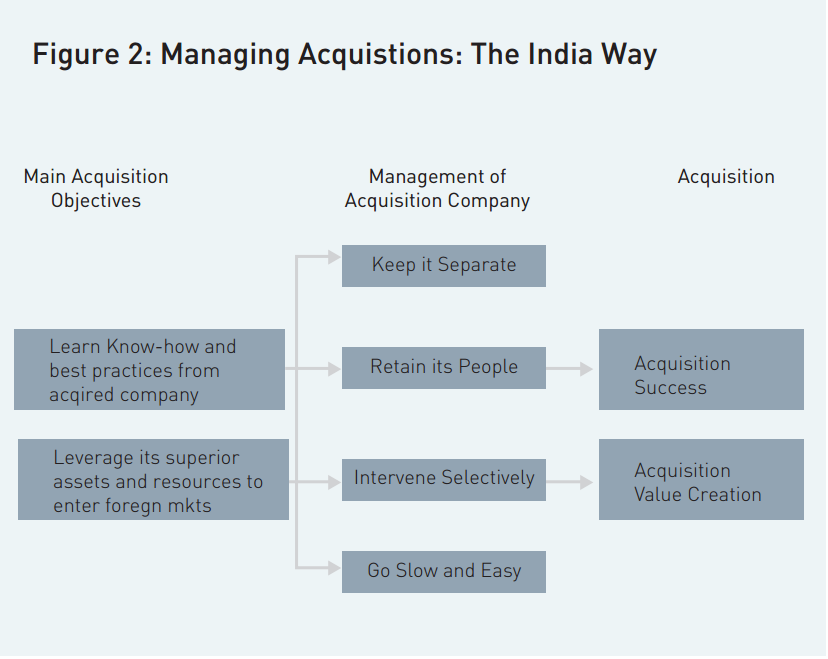

Professor Prashant Kale examines the distinctive approach of Indian companies to managing their overseas acquisitions and why it has proved fairly successful thus far. However, in the face of changes in domestic and global conditions, and possibly in acquisition motivations as well, will the “India way” of managing acquisitions continue to be as effective and relevant?

During the last decade, Indian companies have sought to expand internationally as well as strengthen their position at home against growing competition from global rivals. Sometimes referred to as “emerging multinationals,” these companies have used overseas acquisitions as a key part of their internationalisation strategy. From a mere trickle in the year 2000, Indian companies’ overseas acquisitions activity peaked in 2007 when they spent almost US$35 billion on these transactions (Figure 1). Companies of large business groups such as Tata, Aditya Birla, Bharti, Mahindra, etc., have been at the forefront of internationalisation, but many single business and mid-sized Indian companies such as Marico, Bharat Forge and KPIT- Cummins have also joined the fray. Acquisition activity has been most pronounced in the automotive, metals, telecommunications, pharmaceuticals, consumer goods, engineering and information technology (IT) sectors.

Some overseas acquisitions, such as Tata Steel- Corus, Suzlon-RE Power or Dr Reddy’s- Betapharm have faced challenging times. But as several large sample research studies show, Indian companies have generally been quite successful with their overseas acquisitions1, both in terms of creating value for the acquirer companies’ shareholders as well as the long-term performance of the firm or acquisition. The eventual success (or failure) of any acquisition depends not only upon the acquirer’s objectives and the attributes of the acquired firm, but also – most importantly – upon how the acquiring company manages the acquired firm after completing the deal.

Thus, in this article, we highlight some of the key elements and the underlying rationale of Indian companies’ approach to managing their overseas acquisitions. Recently, a couple of books have been written about the unique “India way” of doing things in areas such as “leadership” or “innovation.” In that light, our description here plausibly reflects the “India way” of managing overseas acquisitions – an approach that is distinctive and seems to have worked well thus far. That said, as conditions evolve, this approach may not be optimal for all acquisitions in future.

Overseas Acquisitions: A Platform for International Competitiveness and Growth

Companies acquire overseas firms to acquire brands, gain access to their sales and distribution channels, acquire advanced technology or know-how, or access management talent. In addition, by acquiring and combining some operations with an overseas firm, Indian companies can increase their size and scale to reduce costs in a variety of ways. A survey we conducted suggests that for many Indian companies, the former reasons may be more salient than the latter2.

When Hindalco acquired Novelis, Aditya Birla Group Chairman Kumar Birla said to Bloomberg Businessweek on February 13, 2007 that, “We were attracted to Novelis by its global size but more importantly, its cutting edge technology that would have taken us decades to build.” Similarly, when Godrej Consumer Products (GCPL) acquired Keyline, GCPL Chairman Adi Godrej commented to Business Standard, November 1, 2005 that , “Acquisition of strong overseas brands that have synergies with our competencies is one of our key strategies for strengthening our competitive position.”

These motives are not surprising. After India began liberalising its business environment from the mid-1990s onwards, there was a significant increase in the entry and expansion of global players in India. To face this growing foreign competition at home, Indian companies had to up their game; they had to strengthen their own technological know-how and other capabilities, and acquiring overseas companies and accessing their know-how and learning from it was a quick way to do that. Additionally, liberalisation also made it more attractive for Indian companies to enter foreign countries and tap into the customers there. But by virtue of being new to overseas expansion, many Indian companies lacked the know-how, name recognition or channels to easily reach customers in those markets. Once again, acquiring overseas companies and securing proprietary access to these assets provided a quick means to address this gap.

Thus, Indian companies acquired overseas firms mainly as a platform to acquire some critical resource or know-how from them in order to become more globally competitive themselves, and to exploit those companies’ brands, relationships and channels to ease their entry and expansion in new foreign markets. In contrast, reducing costs has been a relatively less critical motive for most Indian companies that do overseas acquisitions. The fact that the Indian economy did reasonably well during 2000-07 also meant that Indian companies were able to use their strong position during that period to embark on this journey. Their growth and business performance in India provided them the confidence, cushion and cash to expand overseas through acquisitions.

Companies acquire overseas firms to acquire brands, gain access to their sales and distribution channels, acquire advanced technology or know-how, or access management talent.

1. Structure: Keep it Separate

The acquirer needs to first decide whether it should “fully combine” the structure of the acquired company with its own, or whether it should keep that company “separate” – with its own organisation and structure intact – and independent. There are tradeoffs associated with each alternative. Western multinationals generally prefer fully combining the acquired company with their own and having a single entity and structure. Internally, this enables greater and faster homogenisation of the working practices and styles of the two companies, and externally, it presents a single face and identity to their customers, suppliers and other stakeholders.

In contrast, most Indian acquirers have preferred the latter (keep it separate) approach, and there are several reasons for (and benefits to) doing that. Externally, it preserves the identity of the acquired company with respect to its extant customers, suppliers, etc. This helps the Indian acquirer, which intends to leverage those relationships to accelerate its own entry and expansion into that foreign market. Internally, fully absorbing the acquired company and its structure can also cause many disruptions: it can potentially disrupt some of the capabilities and processes of the acquired company that the Indian acquirer can benefit from; in addition, employees of the acquired company may experience loss of independence and control and consequently some of them may choose to leave. If the main objective of the Indian acquirer is to leverage some of the extant capabilities of the acquired company and/ or acquire and learn from the know-how of its people, these internal disruptions can be value destroying. Instead, keeping the acquired company separate, with its own identity and structure intact, would be a better way to achieve those objectives.

2. People: Retain Most of Them

Many Western multinationals fully replace the senior management team of the acquired company with their own. This gives them greater control over the acquired firm’s operations and also enables a more rapid transformation of its working practices to that of the new parent. The underlying assumption in such cases is that the acquirer has superior practices and know-how that can be passed on to the acquired firm to improve its performance. Again, many Indian acquirers have chosen to do quite the opposite here because of the potential benefits.

The Indian acquirer is often less knowledgeable about or known in, the foreign markets it enters. By retaining the senior management team of the acquired company, the Indian acquirer can retain and leverage its knowledge of the industry and competition in that country to make its own inroads there and/ or also manage the business of the acquired company. They can also exploit these managers’ network of business or social relationships to sustain and grow the business of both organisations.

In addition, by retaining the acquired company’s senior management team, an Indian acquirer is sending a signal to the rest of the organisation that it values and respects what they bring to the table, which in turn helps create a positive climate for the acquired company and boost the morale of its people. Certainly, there is a cost to takingthis approach: the financial cost of employing foreign senior managers may be higher than the cost of replacing them with Indian managers; further, it can sometimes engender resistance to accepting inputs or practices from the new Indian owner. But given the acquisition objectives of Indian owners, the benefits of retaining these people are presumably far higher than the related costs.

This philosophy is reflected in the comments of several Indian chief executive officers (CEOs). In one-to-one inter views over 2008-09 Baba Kalyani of Bharat Forge, which has acquired several overseas companies said, “We rely on local management entirely.” B Muthuraman of Tata Steel made a similar comment in the same 2008-09 series of inter views when his company acquired NatSteel in South East Asia, remarking, “It is a proud company with a rich history and one needs to respect that – it has given us a management team with a wealth of experience and expertise.”

Indian companies acquired overseas firms mainly as a platform to acquire some critical resource or know-how from them in order to become more globally competitive themselves, and to exploit those companies’ brands, relationships and channels to ease their entry and expansion in new foreign markets.

3. Processes: Intervene Selectively to Enable Sharing and Synergies

Acquirers need to integrate their processes and activities with their acquired firms if they want to enjoy the joint benefits of coming together. Many Western multinationals integrate their activities quite tightly with acquired firms for this purpose. On the other hand, since most Indian acquirers keep the acquired firm as a separate entity, how do they achieve the desired coordination? We find that instead of tight and complete integration of processes between the two companies, Indian acquirers intervene “selectively” by using mechanisms to coordinate only the task at hand. For example, when Tata Steel acquired Corus, it formed joint task forces or committees to facilitate sharing of know-how and best practices.

Alternatively, a group of managers from one company may relocate to its partner firm (or vice versa) for a certain period to enable this exchange. In other cases, such as Tata Tea Tetley, the acquiring firm may use joint teams in relevant areas such as procurement, design or manufacturing to achieve the desired synergies. Sometimes they follow similar management processes such as “the annual strategy planning process” or “common financial reporting systems” in both companies to better align their operations; however, this is done on a selective basis rather than mandating it across the board. This was reflected in Mahindra and Mahindra Chairman Anand Mahindra’s comment in the context of his company’s acquisitions made in one-to-one inter views over 2008-09, “There has to be a Mahindra way of doing things after becoming a part of us – we seek benign but impactful points of intervention.”

4. Speed: Go Easy and Slow

Multinationals such as General Electric (GE), Cisco, or Oracle tend to quickly absorb and integrate the companies they acquire so that they can rapidly realise the expected synergies. In contrast, Indian acquirers have gone about this more slowly; they take time to understand the concerns of the overseas companies’ employees and do not make quick changes in the management, processes or brand architecture of those companies. This allows them to avoid any pitfalls that can potentially jeopardise the operations of the acquired company. It also gives the acquirer time to create a more positive image among the internal and external stakeholders of the acquired company and engender their cooperation. Tata Chemicals adopted this approach when it acquired Brunner Mond, its first large overseas acquisition. Homi Khusrokhan, the CEO at that time, said in an inter view in 2008- 09, “We were very gentle and patient in our dealings – not looking for quick fixes. In the initial phase, we focussed more on the softer side, which takes time.”

A variety of evidence shows that Indian companies have generally done reasonably well with the overseas acquisitions they made during the 2000-2010 period.

Acquisition Performance

A variety of evidence shows that Indian companies have generally done reasonably well with the overseas acquisitions they made during the 2000-2010 period. These sources include:

• Numerous case studies, accounts in the press and management books, which provide a qualitative account of select overseas acquisitions by Indian companies3.

• Large sample surveys of senior Indian managers whose companies have been involved in overseas acquisitions.

• Large sample, empirical studies based on secondary, archival data4.

Collectively, these data suggest that, on average, Indian companies have achieved their primary objectives in undertaking overseas acquisitions; senior managers in these companies are generally satisfied with the eventual outcome; and that these acquisitions have created value for the companies and their shareholders both in terms of accounting and stock market returns.

Overseas Acquisitions: Some Challenges and Constraints

While the general performance of overseas acquisitions of Indian companies has been satisfactory, some transactions have faced challenges. The global meltdown in 2007-08, followed by the economic slowdown in Europe which persists to date, has meant that in some cases (such as Tata Steel-Corus or Suzlon-RE Power), the revenue growth in these acquisitions has not materialised as per expectations. This has resulted in the sharp scaling down of targets, operational restructuring, job layoffs and asset write- downs. In other cases, such as Dr Reddy-Betapharm, unexpected changes in government policies negatively impacted the growth assumptions built into the business case5. In these situations, the adverse impact has been manifold if the Indian company had made the acquisition through an auction (which increases the chances of overpayment) and/ or taken a large amount of foreign currency debt to fund it. While some of these companies have recorded millions of dollars of impairment charges on their books to account for this in the near term, turning around these acquisitions strategically and operationally will be a much longer endeavour. The fact that in some of these acquisitions, the Indian acquirer also initially followed the “India way” of doing acquisitions, meant that some of the gains they achieved by joining hands with the acquired company were realised relatively slowly, and hence, were not able to offset the unexpected challenges that arose in the near to medium term.

By retaining the acquired company’s senior management team, an Indian acquirer is sending a signal to the rest Of the organisation that it values and respects what they bring to the table, which in turn helps create a positive climate for the acquired company and boost the morale of its people. The India Way: When Does it Work and How Might that Change?

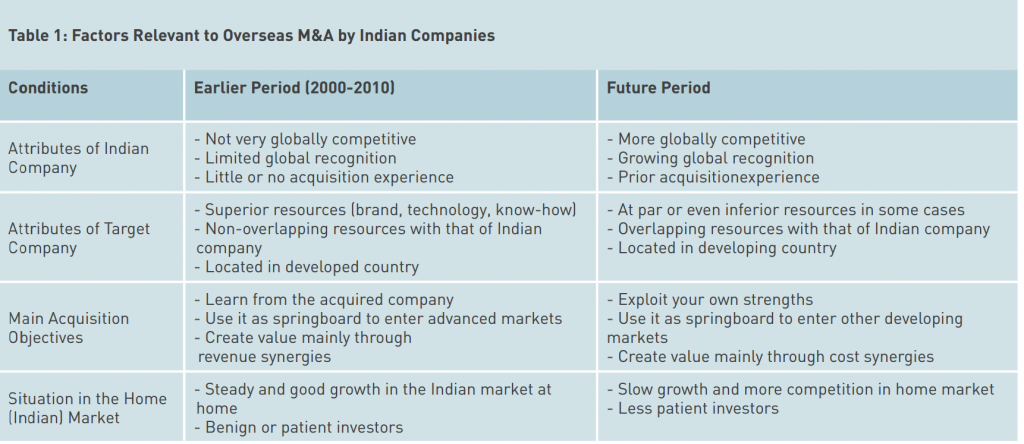

Overall, the distinctive “India way” of managing acquisitions has merits. But we must appreciate that conditions during the first decade of Indian overseas expansion through acquisitions were also quite unique in certain respects that were conducive to this approach, such as the status/ stature of Indian companies during the early part of this decade, their motivations for overseas acquisition and the business conditions in their home market.

When Indian companies initially began expanding internationally (or faced global competition at home), they lacked sufficient name/ brand recognition in international markets as well as the understanding and capabilities to break into those markets. They were also not globally competitive enough (in terms of technology, management practices or even size and scale). Thus, acquiring overseas companies that had superior and complementary strengths in these respects addressed this gap. Keeping them separate, with their structure and management team intact, mitigated any disruption to the resources or assets being sought. The main objective was to leverage the acquired companies’ brands, channels and relationships to increase sales internationally and/ or learn from their technical know-how and best practices.

While this minimal and gradual integration may have required more time to achieve the desired results, Indian acquirers (and their investors) may have been prepared to tolerate this because their business in India was still growing rapidly enough. To add to this, Indian companies did not have sufficient acquisition experience to understand or manage all the complexities of an (overseas) acquisition; consequently, a gradual and less inter ventionist approach was a good way to keep it simple and learn as they went along. A senior executive of a large Indian company told us during an interview that, “We in India do acquisitions this way, which is different from typical Western MNCs, and we’ll not change that.”

But as the saying goes, “never say never,” and that may be true for Indian acquisitions as well because some of those earlier conditions have partly changed (Table 1). Today, several Indian companies are quite competitive globally and their name/ brands are also well recognised in some international markets. Thus, some of the companies they acquire now and their reasons for those acquisitions may be different than before. Some acquisitions may still be motivated by the desire to acquire superior resources such as brands, technology or other know-how from the foreign target; but in other cases, Indian companies may do acquisitions to exploit their own superior resources through the acquired company.

In difficult global business conditions, acquisitions may also be motivated simply by the desire to “reduce costs” by combining “similar assets or activities” across two companies and to realise benefits through greater size, scale and elimination of duplication. In such situations, the traditional “India way” may not be optimal; instead, Indian acquirers may need to adopt a more heavy-handed approach (with tighter integration of the acquired company and/ or replacement of its people/ assets to some extent) to realise the expected benefits. Changing external conditions in India may also require a change in the speed of post-acquisition integration. The minimal and gradual approach to integration results in the slower realisation of expected acquisition benefits. Earlier, the growing domestic Indian market provided Indian companies with a cushion, due to which their shareholders were perhaps prepared to be patient if the acquisition benefits were slow to come. However, with the slowdown in domestic business growth, shareholders may push Indian acquirers to move faster to achieve expected acquisition benefits, and consequently, require these companies to change their traditional approach to managing acquisitions.

Multinationals such as General Electric (GE), Cisco, or Oracle tend to quickly absorb and integrate the companies they acquire so that they can rapidly realise the expected synergies. In contrast, Indian acquirers have gone about this more slowly; they take time to understand the concerns of the overseas companies’ employees and do not make quick changes in the management, processes or brand architecture of those companies.

Thus, in the future, Indian companies will have to decide carefully when the India way, which has traditionally encompassed a light-handed approach to acquisitions, is suitable for managing overseas acquisitions and when this approach needs to be adapted or even changed outright. Some Indian companies may be able to successfully navigate this change; other firms, where this approach is more institutionalised or ingrained in their culture or DNA, will find it difficult to do so. In that case, one option is to only do those acquisitions that are better suited to this approach, even if it means avoiding other types of acquisitions that present a potential business opportunity.

FURTHER READING

[Editor’s note: Readers will notice several parallels in the findings reported in the previous article in this issue by Professor Raveendra Chittoor and Deepak Jena, “Understanding the Overseas Acquisitions of Indian Transnational Corporations” and the present article by Professor Prashant Kale. These similarities in findings on acquisition motivation, post-acquisition integration among other aspects are interesting, but note that the two articles draw on different sets of studies and data.]NOTES

1 These studies include, for example, large sample studies such as Gubbi et al (2010) (see note below for full reference); Kale, P (2009). “The global Indian firms: Growth and value creation through overseas acquisitions”, Indian Journal of Industrial Relations, 45: 41-53; Ray, S and S Gubbi (2009). “International acquisitions by Indian firms: Implications for research on emerging multinationals”, Indian Journal of Industrial Relations, 45: 11-26.

2 Please refer to Kale, P, H Singh and A Raman (2009). “Don’t Integrateyour Acquisitions – Partner with Them”, Harvard Business Review, 87(12):109-119.

3 Please refer to Kumar, Nirmalya (2007). India’s Global Power Houses: How They are Taking on the World (Boston: HBS Press) and Chattopadhyay, A, R Batra and A Ozsomer (2012). The New Emerging Market Multinationals (McGraw-Hill).

4 Please refer to Gubbi, S R, P S Aulakh, S Ray, M B Sarkar, and R Chittoor (2010). “Do International Acquisitions by Emerging Economy Firms Create Value? The Case of Indian Firms”, Journal of International Business Studies, 41:397-418.

5 See the interview with GV Prasad in this issue.