Social Impact Bonds are pay for success contracts between the private and public sectors (government) for the financing of social programmes. The contracts incentivise the providers of social services to deliver their programmes in a cost effective manner with a greater focus on outcomes. Professor Karan Bhanot examines how social entrepreneurs can draw some lessons from recent pilot programmes in the United Kingdom and United States that have proved successful in drawing the interest of market participants.

Introduction

India spends more on social programmes than most developing countries (Timmons, 2011). Social programmes such as efforts to reduce homelessness or to bring juvenile offenders into the mainstream are financed by specified governmental agencies or philanthropic organisations. The idea behind such remediation programmes is that the cost to society from not providing a social programme far exceeds the costs of the programme. For example Economist (2013) reports that 65% of young offenders who are incarcerated commit another crime within the next three years. However a remediation programme costs far less than the long term facility to house these juveniles. Private capital for social programmes is not generally feasible because the benefit of the programme accrues to the government and tax-payers at large or to the individuals in the programmes, and there is no obvious way to get a return commensurate with the risk of the investment. Social Impact Bonds are financial contracts that facilitate the financing of social programmes via the private sector.

Social Impact Bonds are pay for success contracts between the private and public sectors (government). Capital is raised from private investors via sale of social impact bonds to fund a social programme or intervention. The return on these bonds is linked to the performance of the programme. Reimbursement or payments to investors comes from the government, and is triggered by the results of the intervention. Thus Social Impact Bonds are pay for success investments wherein the return depends on the performance of the programme.

Traditionally, funding for social programmes has come from private philanthropic sources or from municipal and state governments. With budget constraints governments can provide limited funding for services when considering the capital risk, even if potential benefits outweigh costs. The use of incentive payments in the pay for success model shifts capital risk from governments to investors, expanding the funding channel for social preventative services. In addition to increased access to funding, service providers will be incentivised to focus on outcomes and not input, providing improved efficiency and innovation in social services and their delivery. These aspects are particularly important in India where the delivery of services is poor and middle men and administrators divert a large part of the resources earmarked for the target audience of social programmes.

With budget constraints governments can provide limited funding for services when considering the capital risk, even if potential benefits outweigh costs. The use of incentive payments in the pay for success model shifts capital risk from governments to investors, expanding the funding channel for social preventative services.

Recent Examples

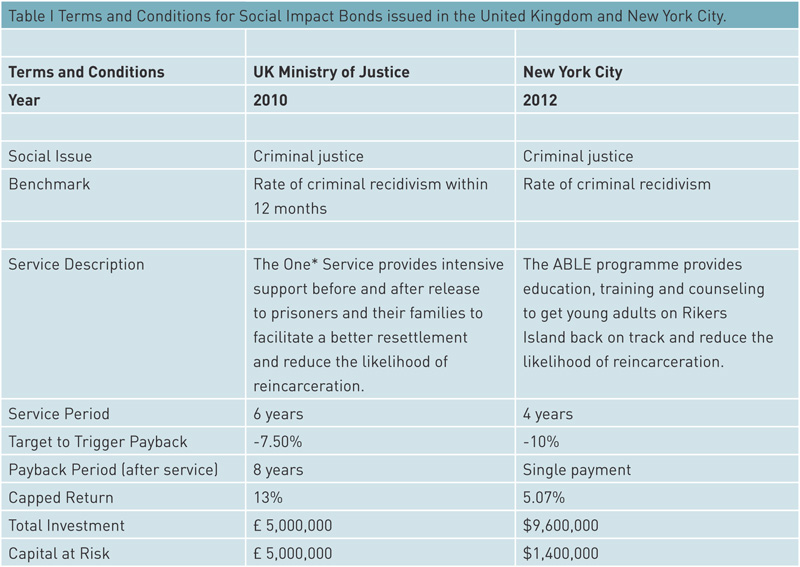

Social financing is a relatively new phenomenon and was first introduced in United Kingdom in 2010 to finance a programme to remediate juvenile crime (Table 1 provides details of the financing arrangement used in United Kingdom). Following the successful financing of this programme, similar arrangements have been initiated in the United States – e.g., to provide financing for a programme to reduce recidivism rates for juveniles at Rikers Island prison in New York City; for preventative healthcare to reduce asthma rates in Fresno, California (Badawy, 2012) and to remediate homelessness in United Kingdom (Wintour, 2012). The size of the market for social programmes and the renewed possibility of private investors have drawn the interest of investment banks. For example, Goldman Sachs was involved in the financing of the Rikers Island bond (City of New York Memo, 08/02/2012) and consulting companies such as McKinsey & Company, Inc. have a team explicitly devoted to developing expertise in this area (McKinsey, 2012).

Peterborough Social Impact Bond

In September 2010, the world’s first social impact bond was launched in the United Kingdom in hopes to reduce the re-conviction rates of people sentenced for less than twelve months. The UK Ministry of Justice entered into the agreement with four organizations (St. Giles Trust, Ormiston Children and Families Trust, Young Men’s Christian Association, and Sova) to provide such people with accommodation, medical services, family support, employment and training and financial advice. Seventeen investors funded the £5 million contract (Cave et.al. (2012)). The investors will receive their principal back if the reconviction rate (within twelve months of release) falls by a minimum of 7.5%. If the reconviction rate falls more that 7.5%, investors will receive additional returns. The returns increase with reduced reconviction rates and is capped at a maximum of 13%. The payments are made over an eight year period after the project is evaluated.

New York City Social Impact Bond

In 2012, the United States followed suit, issuing its first Social Impact Bond targeting juvenile delinquents in New York City. The Social Impact Bond funds the Adolescent Behavioral Learning Experience (ABLE), a programme being implemented at Rikers Island to educate young offenders and improve their cognitive skills. Prior to the program, almost half of adolescents leaving the New York City Department of Corrections returned within one year (City of New York Memo, 08/02/2012).

The primary investor in this project is Goldman Sachs with a contribution of $9.6 million. The investment is in the form of a loan to the MDRC, a leading nonprofit organization. Bloomberg Philanthropies agreed to compensate Goldman Sachs $7.2 million if the target is not achieved. If the goal is achieved, Goldman Sachs will get its promised return on investment. If the recidivism rate improves beyond the target, Goldman Sachs will receive a payment of upto $2.1 million, beyond its $9.6 million investment.

Evidence Based Social Programmes

It is important to recognize that not all types of social programmes are amenable to Social Impact Bond financing. The programmes need to have clearly defined and measurable benchmarks wherein the cost savings from the private financing are commensurate with the costs incurred. The criminal justice system and the remediation of homelessness are two examples.

It is important to recognize that not all types of social programmes are amenable to Social Impact Bond financing. The programmes need to have clearly defined and measurable benchmarks wherein the cost savings from the private financing are commensurate with the costs incurred.

Criminal Justice

The purpose of criminal justice social programmes is to reduce the rate of criminal recidivism, lowering both correctional costs to the government and the burden of crime on society. Aos, et al. (2001) examine the cost effectiveness of juvenile and adult corrections methods on reducing recidivism rates. Adult programmes that exhibit positive net benefits before including broader societal benefits include: a wide variety of non-residential substance abuse treatment and education programmes in prisons, cognitive behavioural therapy, job counseling and searches, basic education (mathematics, reading, and writing), and in-prison vocational training. Once these pilot programmes are complete, they will shed new light on their actual effectiveness on recidivism and taxpayer benefits. MacKenzie (2000) provides a review of the literature on corrections and its impact on recidivism. The review finds numerous effective methods including: therapeutic communities in prisons with community follow-up, cognitive behavioural therapy, and vocational education programmes.

Homelessness

According to the Annual Homelessness Assessment Report from the Department of Housing and Urban Development in the US, as of January 2012, there were over 107,000 chronically homeless people in the United States. A chronically homeless person is someone with a disability and who has been continuously homeless for a year or more or has experienced at least four episodes of homelessness over the prior three years. This subset of homeless people accounts for almost 17% of the whole group. In Texas and four other states, one in five homeless people are chronically homeless. Being homeless, especially when coupled with a disability often leads affected individuals into scenarios where they frequent costly remedial public services (i.e., shelter, hospitalisation, incarceration). A study of New York City’s hospitalisation costs by Salit, et al. (1998) found that homeless individuals often have longer and more expensive periods of hospitalsation. Explanations other than increased risks include that some physicians may lower thresholds for admission of homeless individuals and may delay discharge after treatment until a shelter bed is available. Thus there is a direct cost to society from homelessness. If proven interventions can be scaled to significantly reduce the use of public services by the homeless, economic value can be created for municipal and state governments, and the investors who provided the capital to expand the programmes. This economic value is in addition to the direct improvement on society.

Supportive housing programmes provide individuals with housing arrangements and access to community or site-based support services. Larimer, et al. (2009) study a supportive housing programme in Seattle for individuals with severe alcohol problems. They found a significant reduction in the use of health and criminal justice services after only six and twelve months, reducing the public’s cost. Martinez and Burt (2006) analyze the impact of supportive housing in San Francisco and find that after being placed in the programmes, individuals significantly reduced the number of visits they made to the emergency department and also had a lower probability of being hospitalised than prior to their supportive housing. The results of the New York agreement were examined by Culhane, et al. (2002) and found that costs across eight different public systems were significantly decreased for individuals after they participated in the supportive housing programme. With individuals receiving preventive treatments in the initial stages of the programme it is reasonable to expect the possibility of improvements from treatments and cost savings to accrue during the treatment period. As time goes on the savings eventually offset the total costs of supportive housing.

A social programme is feasible if the expected present value of the benefits to society is higher than the total investment (where cost of capital to the government equals its borrowing rate).

Essential Ingredients of Social Impact Financing

Academic research characterizes the manner in which contracts should be structured to make them optimal. An optimal contract is one that achieves the desired objectives of the program in a way that it is financially viable for all parties and incentivizes the implementing agency to put in maximum effort. The contract therefore includes incentive payments coupled with a threat of replacing the agency in case of non performance. The magnitude of incentive payments and the conditions in which the replacement decision is made depends on the features of the social program and the ability to separate out the noise in outcomes of the program from actual performance and effort based outcomes.

Feasibility of Social Programme

A social programme is feasible if the expected present value of the benefits to society is higher than the total investment (where cost of capital to the government equals its borrowing rate). In addition to the savings after completion of the programme, there are possibly some interim savings during the implementation and evaluation period of the programme.

The objective of a typical social programme is to reduce some social cost in the most effective manner. For example, in the setting to remediate homelessness the cost includes items such as increased hospitalisation for the homeless or in the case of juvenile crime it includes the cost of re-incarceration amongst other costs. Clearly not all types of social programmes are amenable for such financing. The social bond increases costs that must be offset by higher performance and can only be viable in certain settings. The target audience of a social programme (e.g., number of homeless individuals in a group or the number of asthma patients in a city) must be identifiable and the benefits of the programme must be evidence based. Disagreement of the amount of these costs changes the tradeoffs faced by the government or financing agency, but the analysis presented is still applicable.

In addition to the multi-agent setting, the nature of a social project is different from typical investments- these projects are consummated over many years and the results are not apparent right away. As a consequence it is difficult to characterise the dynamics of the project outcomes with precision during the course of the programme. The success of a programme may not be apparent until a few years after the programme completion.

Participants

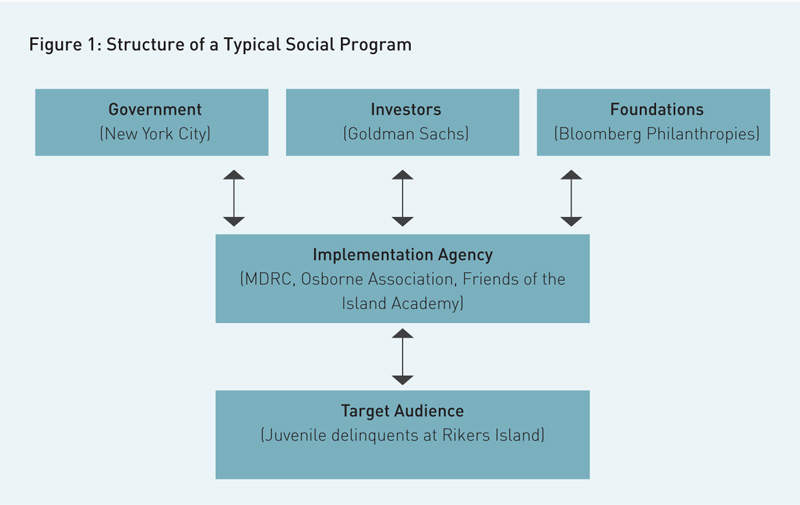

Since the social programme is a multi-party venture, each participant analyses the incentives from its own vantage point (Figure 1). The main financial participants are government and non-profits, investors, implementation agency and the evaluation agency.

•The Government provides the payments to the investors in the form of return of the principal amount and incentive payments. In addition to payments at the conclusion of the program, the government may agree to provide interim payments if the incremental social benefits are positive during that period. Private Foundations provide funding if the social benefits are positive and may have a lower threshold than the government. In other words foundations may be willing to accept a lower return than the risk-free rate.

•Investors provide the initial capital and in turn require a fair return on their initial investment. The return may include an incentive component in case the performance is better than a predetermined benchmark.

•The Implementation Agency hired by the investors performs the functions required of the social programme. It collects the initial investment from the investors to get the programme under way. The initial investment should exceed the set up costs. Also, increased effort should be rewarded.

•Evaluation Agency measures the outcomes of the programme. The agency must be independent and also be able to benchmark the performance of the programme against what is ‘normally achievable’ without incentive payments.

The Social Impact Bond Contract

A Social Impact Bond contract thus specifies:

•The social programme details including the amount of funding required, benchmark performance and the time to completion of the project. The social programme requires an initial investment to finance the implementation of the programme. In general this includes the initial investment as well as the present value of promised infusions through the time required to run the programme. These costs include any office and manpower costs to implement the programme. The expected completion time of the programme is fixed. It is possible that the programme evaluation is done only once after the completion of the programme. However, in most cases there is continuous evaluation in the interim. The social benefits accrue after the completion of the program

•The amount of funding from investors, rate of return to be agreed upon, setting of benchmarks for the implementation agency and incentives. The impact of the social programme depends on the current and past efforts and expertise in implementation. While efforts are not observable and the impact of these efforts are also not certain, the actual benefits are observable and can be contracted upon. The incentives are structured to encourage efforts in a way that maximizes the effectiveness of the programme and reduce the costs of financing, thus improving the return on investment. An important feature is the threat of replacement of the agency under certain conditions.

•The agreement with government and foundations with respect to terms of payment based on the success of the program.

Challenges and Potential for Social Finance in India

India has a plethora of social programmes and has spent nearly two percent of its Gross Domestic Product on social initiatives in 2010 (Timmons, 2011). Many of these social programmes are unable to fully achieve their potential because of middle men diverting money and benefits or because the target audience is not fully aware of these programmes amongst other reasons. A public private partnership with financial incentives that focuses on outcomes and not on inputs would provide improved efficiency and innovation in social services and their delivery. However such a public-private partnership initiative would require political will, a strong and independent evaluation agency for benchmarking the programmes and measuring success, and a simplified process for negotiating with the government. A trial run such as the programme by the Government of UK would be a good starting point. Once proven, the model can be expanded to provide a greater role for the private sector in the implementation and financing of social programmes.

FURTHER READING

Aos, S., P. Phipps, R. Barnoski, and R. Lieb, 2001, The Comparative Costs and Benefits of Programmes to Reduce Crime. Version 4.0, Washington State Institute for Public Policy, Website: http://www.wsipp.wa.gov/Reports/01-05-1201, Accessed on 01/10/2013

Badawy, M., 2012, California City Seeks to Cut Asthma Rate via Bond Issue, Oct 19, 2012, Reuters.com, Accessed on 01/10/2013

Cave, S., Williams, T., Jolliffe, D. and C. Hedderman, 2012, Peterborough Social Impact Bond: an independent assessment, Ministry of Justice Research Series, 8/12.

Culhane, D. P., S. Metraux, and T. Hadley, 2002, Public Service Reductions Associated with Placement of Homeless Persons with Severe Mental Illness in Supportive Housing, Housing Policy Debate, 13, pp. 107-163

City of New York, Office of the Mayor, 2012, Mayor Bloomberg and Deputy Mayor Gibbs and Corrections Comissioner Schriro announce nation’s first social impact bond, 08/02/2012, www.nyc.gov

The Economist, 2013, Suffer the Children, Democracy in America Blog, January 30, 2013, Accessed on 01/03/2014

Larimer, M. E., D. K. Malone, M. D. Garner, D. C. Atkins, B. Burlingham, H. S. Lonczak, K. Tanzer, J. Ginzler, S. L. Clifasefi, W. G. Hobson, and G. A. Marlatt, 2009, Health Care and Public Service Use and Costs Before and After Provision of Housing for Chronically Homeless Persons with Severe Alcohol Problems, Journal of the American Medical Association, 301, pp. 1349-57.

MacKenzie, D. L., 2000, Evidence-based Corrections: Identifying What Works, Crime & Delinquency, 46, pp. 457-471.

Martinez, T. E., and M. R. Burt, 2006, Impact of Permanent Supportive Housing on the Use of Acute Care Health Services by Homeless Adults, Psychiatric Services, 57, pp. 992-999.

McKinsey and Company, 2012, From Potential to Action: Bringing Social Impact Bonds to the US

Salit, S. A., E. M. Kuhn, A. J. Hartz, J. M. Vu, and A. L. Mosso, 1998, Hospitalization Costs Associated with Homelessness in New York City, New England Journal of Medicine, 338, pp. 1734-1740.

Timmons, H, India’s Anti-Poverty Programmes are Big but Troubled, New York Times, May 18, 2011.

Wintour, P., 2012, Social Impact Bond Launched to Help Teenagers in Care and the Homeless, The Guardian. November 23, 2012.